Ford Motor Co.’s market share in Canada may rise to 16 percent this year, from 15.2 percent in 2009, as new models such as the redesigned Fiesta subcompact reach showrooms, the automaker’s regional chief said.

Ford Motor Co.’s market share in Canada may rise to 16 percent this year, from 15.2 percent in 2009, as new models such as the redesigned Fiesta subcompact reach showrooms, the automaker’s regional chief said.Market share in Canada will be in a range of 15.5 percent to 16 percent, David J. Mondragon, chief executive officer of Ford Motor Co. of Canada, said today in an interview in Vancouver. Ford was No. 1 in Canada through February with about 16.2 percent of sales, he said.

“As we bring new products on, there will be an opportunity to grow our share further, but we need to get that product on the ground, we need to launch it and then see how it resonates” with buyers, Mondragon said.

The Fiesta is among eight new vehicles Ford plans to unveil in Canada this year as the Dearborn, Michigan-based automaker seeks to entice consumers with improved fuel efficiency and options such as the Sync voice-activated phone and entertainment system developed with Microsoft Corp.

“We are going to move our company from a niche player to a true competitor” in small cars, Mondragon said. Ford expects the price of oil to soar to $120 a barrel in the coming years, he said, without giving a timetable. Crude for May delivery rose 20 cents to $82.37 on the New York Mercantile Exchange.

First-Quarter Gain

First-quarter sales in Canada rose by about 25 percent from a year earlier, Mondragon said, including a 51 percent gain in February. Sales in March are up about 25 percent, compared with an industrywide increase of about 10 percent in Canada, he said.

Comparisons should be easy for the next several months with the results from a year earlier, when the deepening recession damped demand, Mondragon said.

“As we get into the summer months, though, we’re going to butt up against some very high sales volumes from last year when our sales surged while GM and Chrysler were going through tough times,” he said, referring to the bankruptcy restructurings of the predecessors of General Motors Co. and Chrysler Group LLC.

Ford fell 29 cents, or 2.1 percent, to $13.28 at 4:01 p.m. in New York Stock Exchange composite trading. The shares have risen 33 percent this year.

Through February, Ford had 17.5 percent of the U.S. market, second to Detroit-based GM.

Palm says smartphone sales fell dramatically in its fiscal third quarter, as the company lost ground against Apple and phones built on Google's Android operating system.

Palm says smartphone sales fell dramatically in its fiscal third quarter, as the company lost ground against Apple and phones built on Google's Android operating system.

Nokia has revised its estimates for the global mobile device market and its own market share for year 2009. The company has also updated its global mobile device market estimates for 2010.

Nokia has revised its estimates for the global mobile device market and its own market share for year 2009. The company has also updated its global mobile device market estimates for 2010.

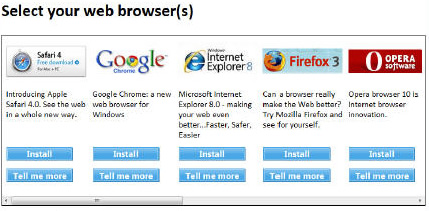

Firefox may never top 25 per cent of the global web browser market, if new statistics are indicative of longer term trends.

Firefox may never top 25 per cent of the global web browser market, if new statistics are indicative of longer term trends.